Discount & Pricing System

Overview

The Municipality Gateway features a sophisticated discount and pricing engine designed to handle complex pricing scenarios common in municipal services. The system automatically calculates discounts based on multiple criteria including family relationships, age, geography, income levels, and time-based rules.

Core Discount Types

1. Family Discounts (Sibling Discounts)

Purpose: Reduce costs for families with multiple children participating in services.

How It Works:

First Child: Full price

Second Child: Configurable discount (typically 20-30%)

Third+ Children: Higher discount (typically 40-50%)

Family Maximum: Optional cap on total family payments

Configuration:

Navigate to Discount Rules → Family Discounts

Set percentage or fixed amount discounts

Define maximum family payment limits

Configure age range restrictions

2. Age-Based Discounts

Purpose: Provide appropriate pricing for different age groups.

Standard Age Categories:

Children (0-12): Reduced pricing for child programs

Youth (13-17): Teen-specific pricing

Adults (18-66): Standard pricing

Seniors (67+): Senior citizen discounts

Dynamic Age Calculation:

System calculates age at service start date

Automatic application based on birthdate

Age verification through National Registry integration

Age based discount

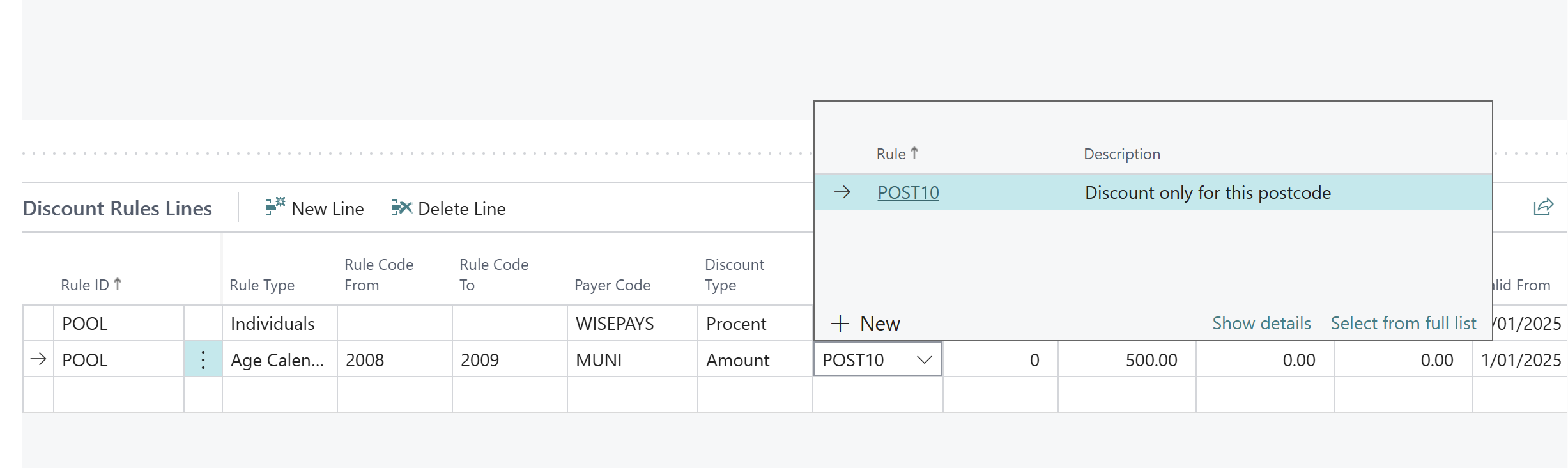

3. Geographic Discounts (Post Code Based)

Purpose: Provide preferential pricing for local residents.

Implementation:

Local Residents: Full municipal resident benefits

Regional Residents: Partial discounts for neighboring areas

Non-Residents: Full pricing or premium rates

Tourist Rates: Special pricing for visitors

Configuration Process:

Navigate to Post Code Rules

Define geographic zones and discount percentages

Set effective date ranges

Configure service-specific overrides

Geographic Discounts (Post Code Based)

4. Income-Based Discounts

Purpose: Ensure service accessibility regardless of economic circumstances.

Discount Tiers:

Low Income: 50-80% discount

Moderate Income: 20-40% discount

Standard Income: No discount

Verification Required: Documentation of income status

5. Time-Based Discounts

Purpose: Encourage early registration and manage capacity.

Common Time Discounts:

Early Bird: Discount for early registration

Late Registration: Penalty fees for late applications

Off-Peak: Reduced rates for less popular time slots

Seasonal: Different pricing by season/term

6. Activity-Specific Discounts

Purpose: Promote specific programs or manage capacity.

Examples:

Multi-Activity: Discount for participating in multiple programs

Loyalty Programs: Returning participant discounts

Group Discounts: Reduced rates for team registrations

Promotional: Temporary special pricing

Discount Calculation Engine

Calculation Priority Order

The system applies discounts in a specific hierarchy to ensure consistent results:

Base Price Determination: Start with service list price

Age-Based Adjustments: Apply age category pricing

Geographic Discounts: Apply residency-based discounts

Family Discounts: Calculate sibling discounts

Income-Based Discounts: Apply need-based reductions

Time-Based Discounts: Add early/late registration adjustments

Activity-Specific: Apply program-specific discounts

Maximum Discount Rules: Ensure discount limits are respected

Discount Combination Rules

Stacking Policies:

Additive: Multiple discounts add together

Maximum: Take the highest applicable discount

Hierarchical: Apply discounts in priority order

Capped: Total discount cannot exceed specified maximum

Example Calculation:

Swimming Course - Child Registration

Base Price: 20,000 ISK

Age Discount (Child): -20% = 16,000 ISK

Family Discount (2nd child): -25% = 12,000 ISK

Local Resident Discount: -10% = 10,800 ISK

Early Registration: -5% = 10,260 ISK

Final Price: 10,260 ISK (Total Discount: 48.7%)Discount Rules Configuration

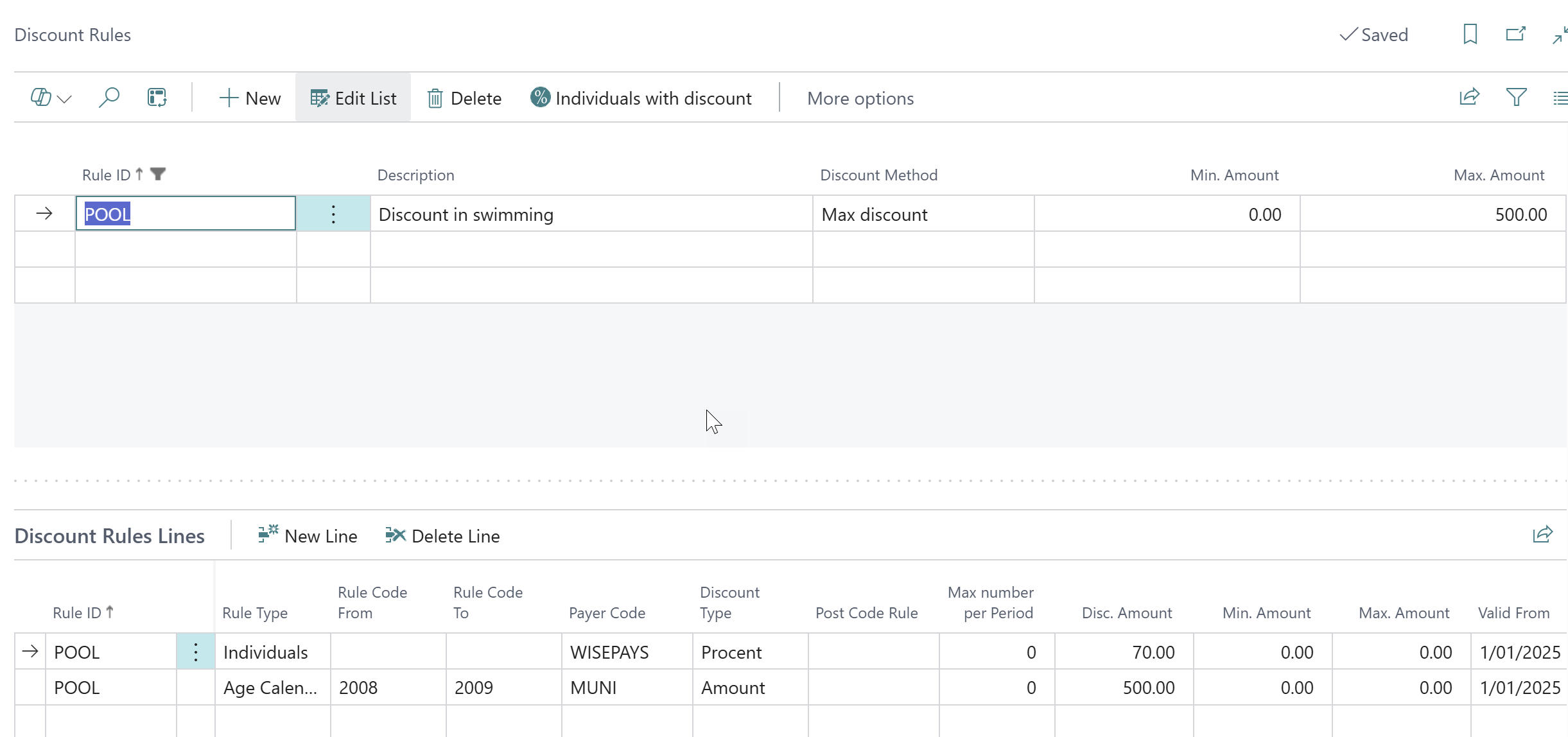

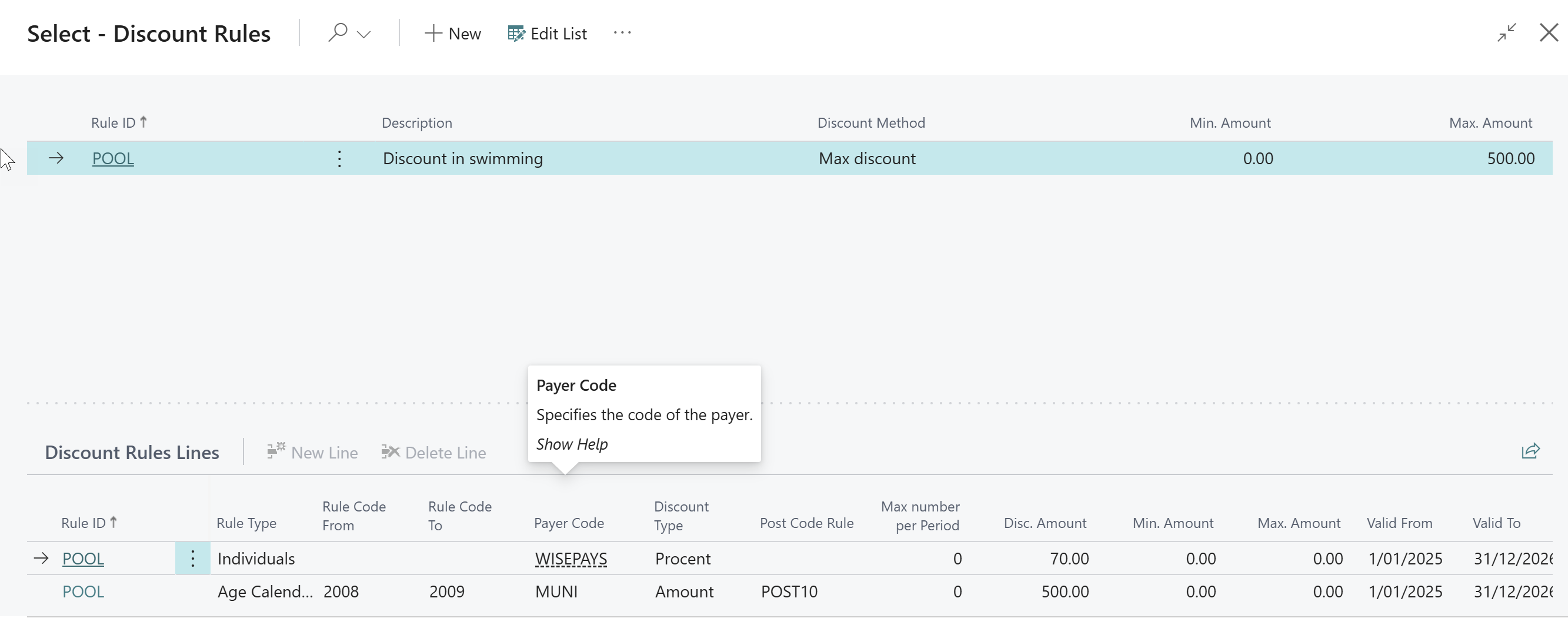

Setting Up New Discount Rules

Prerequisites: Administrative permissions for discount management.

Configuration Steps:

Navigate to Discount Rules:

Municipality Gateway → Setup → Discount RulesCreate New Rule: Click New to create discount rule

Basic Information:

Code: Unique identifier for the rule

Description: User-friendly name

Discount Type: Select from available types

Active Period: When the rule is applicable

Discount Details:

Discount Method: Percentage or fixed amount

Discount Value: Specific percentage or amount

Maximum Discount: Optional cap on discount amount

Minimum Purchase: Threshold for discount eligibility

Applicability Rules:

Service Types: Which services the discount applies to

Age Ranges: Age restrictions for the discount

Post Codes: Geographic restrictions

Time Periods: When the discount is available

Discount list

Advanced Discount Configurations

Conditional Discounts

Set up complex rules based on multiple criteria:

IF participant age between 6-12 AND post code 101-105 THEN apply 30% discount

IF family has 3+ children AND early registration THEN apply additional 10% discount

Tiered Discounts

Create graduated discount structures:

1 child: 0% discount

2 children: 20% discount on second child

3 children: 30% discount on second, 40% on third

4+ children: 30% discount on second, 50% on third and subsequent

Seasonal Variations

Configure different pricing for different periods:

Summer Programs: Premium pricing (June-August)

Winter Programs: Standard pricing (September-May)

Holiday Programs: Special event pricing

Discount Validation and Controls

Automatic Validation

The system performs real-time validation during application processing:

Data Verification:

Age Verification: Cross-reference with National Registry

Address Verification: Confirm post code eligibility

Family Relationships: Validate sibling relationships

Income Documentation: Verify supporting documentation

Eligibility Checks:

Residency Requirements: Minimum residency periods

Previous Participation: Loyalty program eligibility

Service Prerequisites: Required prior participation

Capacity Limits: Available spots for discounted rates

Manual Override Capabilities

When Manual Overrides Are Needed:

Exceptional Circumstances: Hardship cases requiring additional assistance

System Errors: Incorrect automatic calculations

Policy Exceptions: Special municipal decisions

Data Issues: Missing or incorrect participant information

Override Process:

Authorization Required: Manager or supervisor approval

Reason Documentation: Required explanation for override

Approval Workflow: Multi-step approval for large discounts

Audit Trail: Complete record of override decisions

Pricing Models and Strategies

Standard Municipal Pricing Models

Cost Recovery Model

Full Cost Recovery: 100% of service costs covered by fees

Partial Subsidy: Municipality covers portion of costs

Loss Leader: Heavily subsidized to encourage participation

Equity-Based Pricing

Sliding Scale: Fees based on family income

Flat Rate: Same price regardless of economic status

Tiered Pricing: Different rates for different income levels

Market-Based Pricing

Competitive Rates: Match private sector pricing

Premium Services: Higher rates for enhanced offerings

Value Pricing: Price based on perceived service value

Dynamic Pricing Features

Demand-Based Adjustments

High Demand: Increased pricing for popular services

Low Demand: Discounted pricing to encourage participation

Peak Hours: Premium pricing for preferred time slots

Off-Peak: Reduced rates for less popular times

Capacity Management

Early Bird Pricing: Lower rates for early registration

Last Minute: Discounted rates for remaining spots

Waitlist Pricing: Special rates for waitlisted participants

Cancellation Fees: Penalties for late cancellations

Financial Impact Analysis

Discount Usage Reporting

Standard Reports Available:

Discount Analysis by Type: Breakdown of discount usage

Revenue Impact: Lost revenue due to discounts

Participation Rates: Correlation between discounts and enrollment

Geographic Analysis: Discount usage by area

Sample Report Output:

Discount Type | Applications | Total Discount | Revenue Impact | Avg. Discount |

|---|---|---|---|---|

Family Discount | 245 | 2,450,000 ISK | -15.2% | 10,000 ISK |

Age Discount | 189 | 1,134,000 ISK | -7.1% | 6,000 ISK |

Geographic | 156 | 936,000 ISK | -5.8% | 6,000 ISK |

Income-Based | 67 | 1,072,000 ISK | -6.7% | 16,000 ISK |

Budget Planning Integration

Cost Projections:

Discount Budget Allocation: Plan for expected discount costs

Revenue Forecasting: Account for discount impact on income

Participation Modeling: Predict enrollment based on pricing

Break-Even Analysis: Determine minimum participation rates

Common Pricing Scenarios

Scenario 1: Family Recreation Registration

Situation: Family with 3 children (ages 8, 10, 14) registering for swimming lessons

Calculation Process:

Child 1 (Age 8): 15,000 ISK (child rate)

Child 2 (Age 10): 15,000 ISK → 12,000 ISK (20% sibling discount)

Child 3 (Age 14): 18,000 ISK (youth rate) → 10,800 ISK (40% sibling discount)

Local Resident Discount: Additional 5% on total

Final Total: 35,910 ISK (originally 48,000 ISK)

Scenario 2: Senior Citizen Program

Situation: 72-year-old resident registering for fitness classes

Applied Discounts:

Senior Discount: 30% off standard rate

Local Resident: 10% additional discount

Multi-Class: 15% discount for 3+ classes

Final Rate: Approximately 48% total discount

Scenario 3: Income-Based Assistance

Situation: Low-income family seeking childcare services

Process:

Income Verification: Submit financial documentation

Eligibility Assessment: Social services review

Discount Determination: Up to 80% discount approved

Payment Plan: Monthly payment schedule if needed

Ongoing Verification: Annual income review required

System Integration Points

National Registry Integration

Real-Time Data Access:

Age Verification: Automatic birthdate lookup

Address Confirmation: Current residency validation

Family Relationships: Sibling verification

Identity Validation: Prevent fraud and duplicate applications

Financial System Integration

Automatic Processing:

G/L Account Posting: Separate accounts for discounts

Revenue Recognition: Proper accounting for reduced rates

Tax Implications: VAT calculations on discounted amounts

Budget Tracking: Monitor discount budget utilization

Customer Portal Integration

Self-Service Capabilities:

Discount Eligibility: Show available discounts during registration

Real-Time Pricing: Display calculated prices with discounts

Documentation Upload: Submit income verification online

Status Tracking: Monitor discount approval status

Troubleshooting Common Issues

Discount Calculation Problems

Issue: Discounts not applying correctly

Common Causes:

Date Range Errors: Discount rule inactive for application date

Eligibility Failure: Participant doesn't meet criteria

Configuration Errors: Rule setup problems

Data Quality: Missing or incorrect participant information

Solutions:

Verify Rule Configuration: Check discount rule settings

Validate Participant Data: Confirm age, address, family relationships

Check Date Ranges: Ensure rules are active for service period

Review Calculation Log: Examine system calculation details

Integration Issues

Issue: National Registry lookup failures

Solutions:

Network Connectivity: Verify external service connectivity

Authentication: Check service credentials and permissions

Data Format: Validate social security number format

Service Availability: Confirm external service operational status

Issue: Financial posting errors

Solutions:

Account Setup: Verify G/L account configuration

Posting Groups: Check discount account assignments

VAT Configuration: Confirm tax setup for discounted rates

Period Restrictions: Ensure posting period is open

Performance Issues

Issue: Slow discount calculations

Solutions:

Rule Optimization: Simplify complex discount rules

Data Indexing: Ensure proper database indexing

Batch Processing: Process multiple applications together

Cache Utilization: Use cached data for frequent lookups

Best Practices

Discount Policy Management

Regular Reviews: Annually review discount effectiveness

Impact Analysis: Monitor financial and participation impact

Equity Assessment: Ensure fair access across all groups

Policy Documentation: Maintain clear discount policies

Staff Training: Ensure staff understand all discount rules

System Configuration

Test Environment: Test discount rules before production

Phased Rollout: Implement new rules gradually

Documentation: Document all configuration changes

Backup Procedures: Maintain configuration backups

Version Control: Track rule changes over time

Customer Communication

Clear Policies: Publish transparent discount policies

Application Guidance: Help customers understand available discounts

Status Updates: Communicate discount approval status

Appeals Process: Provide mechanism for discount disputes

Feedback Collection: Gather input on discount effectiveness

Next: Payment Processing - Understanding payment methods and financial workflows