Import Journals

The Import Journals module in Wise Municipal Manager provides powerful tools for importing financial data from Excel files into various journal types. This functionality streamlines data entry processes and ensures accurate transfer of external financial information into Business Central.

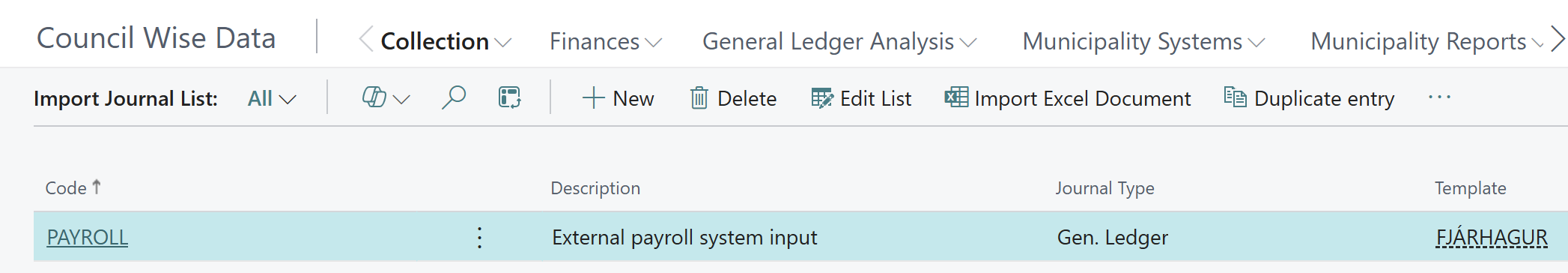

Import Journal list

Key Features

Multi-Journal Support

General Ledger Journals: Import standard general ledger transactions

Fixed Asset Journals: Import fixed asset acquisitions and depreciation

Payment Journals: Import vendor payments with automatic vendor creation

Invoice Batch Lines: Import customer invoicing data with line-level detail

Liquid Asset Management: Import movable asset registrations

Advanced Excel Integration

Flexible Column Mapping: Map Excel columns to Business Central fields

Sheet Selection: Choose specific worksheets from Excel workbooks

Header Line Handling: Skip header rows automatically

Multi-dimensional Data: Support for departments, projects, and business accounts

Data Validation: Built-in validation and error checking

Automated Processing

Document Number Generation: Automatic document numbering

Customer/Vendor Creation: Auto-create missing customers and vendors

Business Account Mapping: Complex mapping based on account, dimension, and business account combinations

Dimension Management: Automatic dimension code validation and assignment

Journal Types and Applications

1. General Ledger Journals

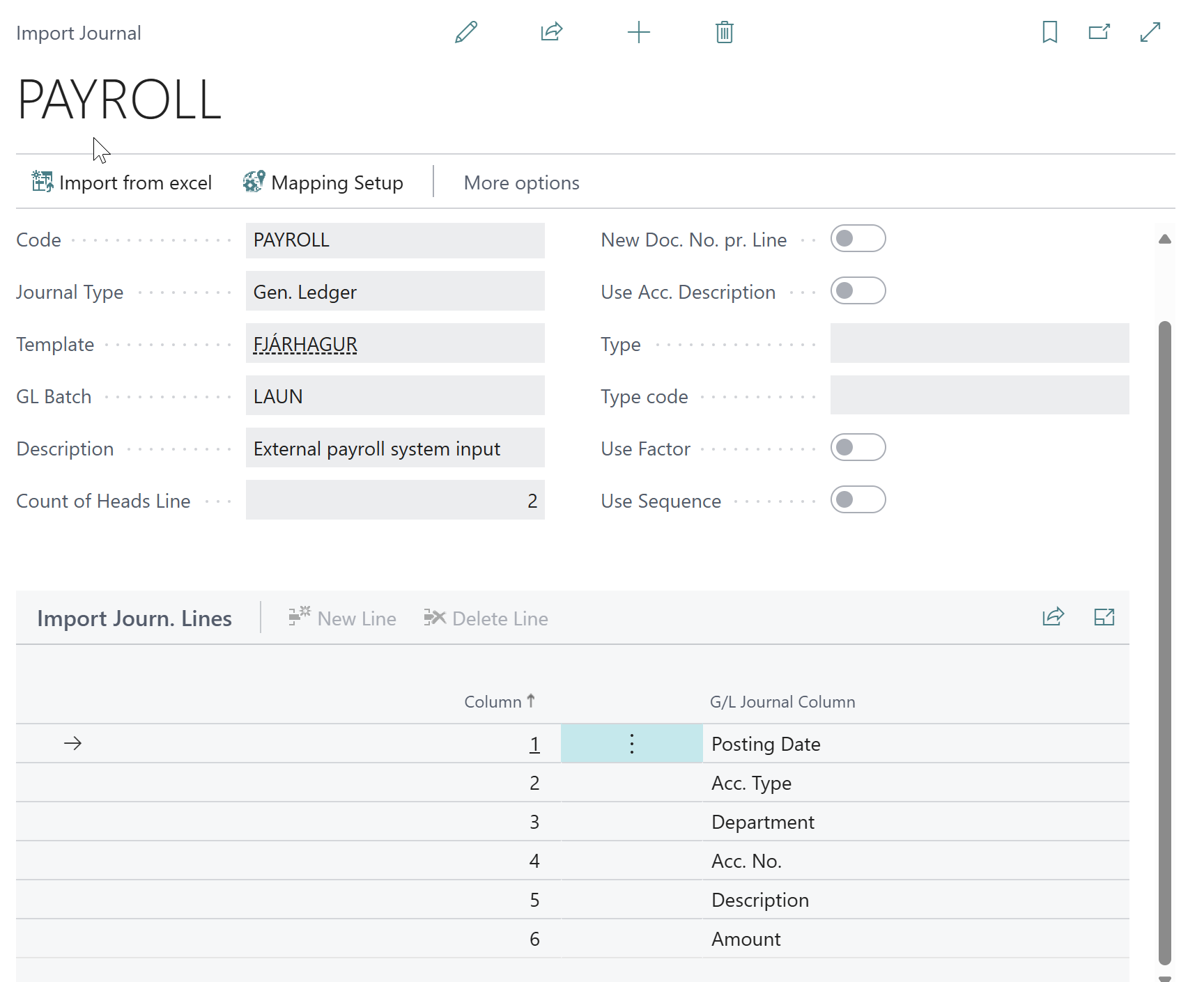

Setup Import journal

Purpose

Import standard accounting transactions from external systems or spreadsheets into Business Central general journals.

Supported Fields

Account Information: Account type, account number, description

Transaction Details: Posting date, document type, document number, amount

Dimensions: Department (Global Dimension 1), Project (Global Dimension 2)

Business Classification: Business account codes for municipal categorization

Additional Fields: Source code, job number, external document number

Fixed Asset Fields: FA posting type, depreciation book code

Balance Account: Balancing account type and number with dimensions

Column Mapping Options

Account Type: G/L Account, Customer, Vendor, Bank Account, Fixed Asset

Account Number: With automatic formatting and validation

Posting Date: Date validation and format conversion

Document Type: Payment, Invoice, Credit Memo, Finance Charge Memo, Reminder, Refund

Description: Text concatenation from multiple columns

Amount: Numeric validation with decimal handling

Dimensions: Department and project code validation

Business Account: Municipal business account classification

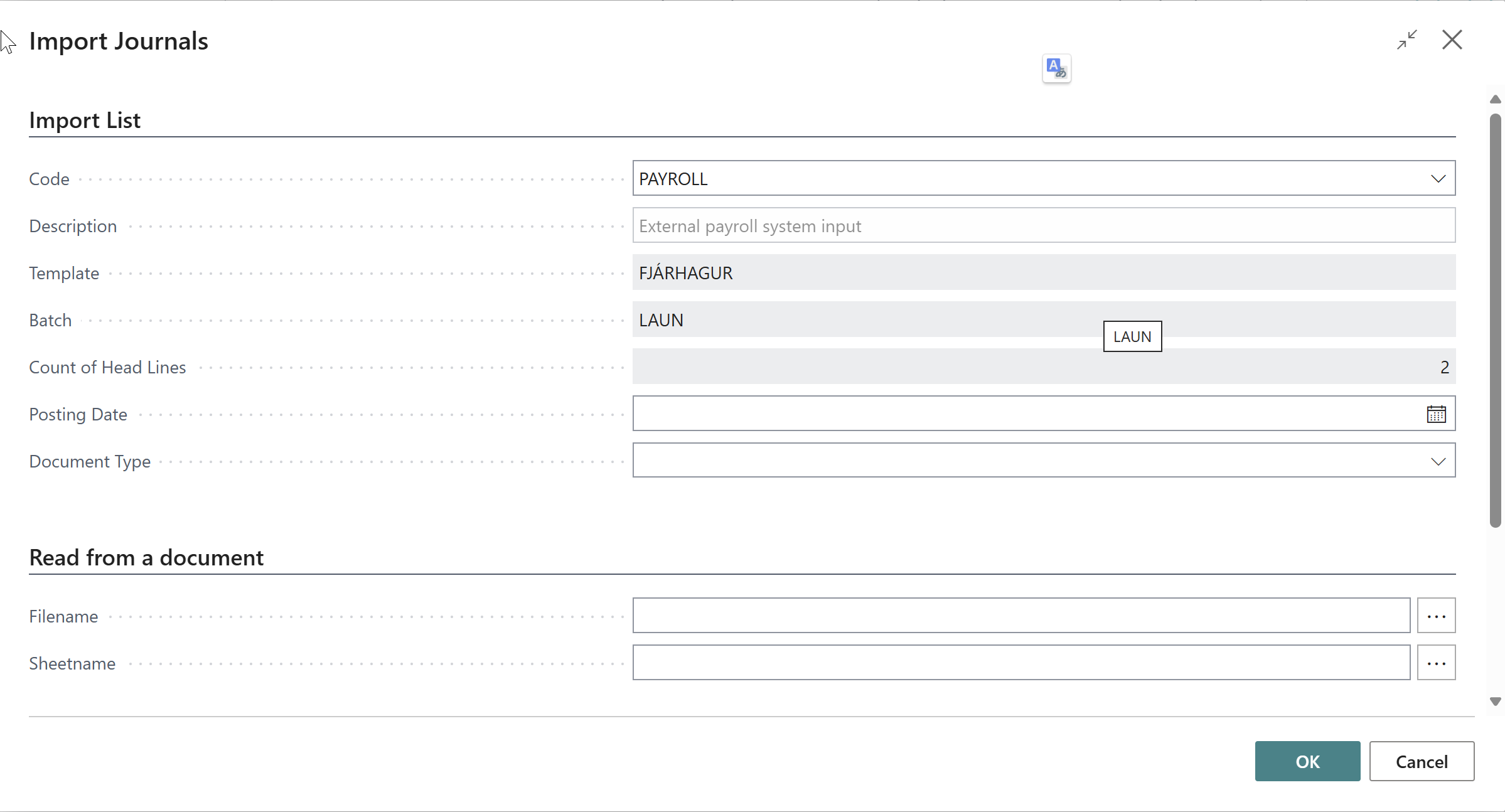

Excel import journal

Import Process

Setup: Define import template with column mappings

File Upload: Select Excel file and worksheet

Preview: Review data mapping and validation results

Import: Process data into selected general journal batch

Review: Verify imported transactions in General Journal

2. Fixed Asset Journals

Purpose

Import fixed asset transactions including acquisitions, depreciation, and disposals.

Supported Fields

Asset Information: Fixed asset number, posting group

Transaction Types: Initial cost, depreciation, write-down, appreciation, disposal

Financial Details: Amount, salvage value, depreciation book

Documentation: Document number, external document number, description

Date Management: Posting date, document date, FA posting date

FA Posting Types

Initial Cost (Stofnkostnaður): Asset acquisition costs

Depreciation (Afskriftir): Periodic depreciation entries

Write-Down (Niðurfærsla): Asset impairment adjustments

Appreciation (Uppfærsla): Asset revaluation increases

Maintenance (Viðhald): Maintenance and repair costs

Screenshot Placeholder: Fixed Asset import showing posting type selection and asset mapping

3. Payment Journals

Purpose

Import vendor payment information with automatic vendor creation and bank account setup.

Supported Fields

Payment Details: Amount, posting date, document number

Vendor Information: Vendor number, name, social security number

Banking Details: Bank number, bank account, account owner

Dimensions: Department, project, business account classification

References: External document number, description

Automatic Vendor Creation

When importing payments for non-existing vendors, the system automatically:

Validates Icelandic social security numbers (kennitala)

Creates vendor records with basic information

Sets up vendor bank accounts with proper formatting

Formats bank account numbers to Icelandic standards (XXXX-XX-XXXXXX)

Assigns default payment terms and posting groups

Screenshot Placeholder: Payment import showing automatic vendor creation dialog

Bank Account Processing

Bank Number: Validates and formats to 4-digit standard

Account Head Number: Formats to 2-digit standard

Account Number: Formats to 6-digit standard with proper hyphenation

Account Owner: Links to vendor social security number

4. Invoice Batch Lines

Purpose

Import detailed customer invoicing data for batch invoice processing.

Supported Fields

Customer Information: Customer number with automatic kennitala validation

Line Details: Description, quantity, unit price, discount percentage

Item/Service: Type (Item, G/L Account, Resource), number, business account

Dimensions: Department, project codes

Additional Text: Before/after line text insertion options

Advanced Features

Customer Auto-Creation: Creates customers from social security numbers

Text Line Management: Insert promotional or informational text

Business Account Integration: Links to municipal service categories

Multi-line Processing: Handles complex invoice structures

Description Concatenation: Builds descriptions from multiple Excel columns

Text Line Options

Before Every Line: Insert text before each invoice line

Top of Invoice: Insert text at invoice header

Before/After: Add text before or after specific line descriptions

5. Liquid Asset Management

Purpose

Import movable asset registrations for municipal asset tracking.

Supported Fields

Asset Identification: Asset number, description, serial number

Classification: FA class, subclass, location, sublocation

Physical Details: Units, acquisition year, acquisition cost

Management: Vendor information, maintenance vendor, global dimensions

Asset Categories

Infrastructure: Vehicles, machinery, equipment

Office Equipment: Computers, furniture, technology

Tools and Equipment: Specialized municipal tools

Facilities: Movable facility assets

Import Configuration and Setup

Import Journal Header Setup

Basic Configuration

Code: Unique identifier for the import template

Journal Type: Determines import behavior and target journal

Template/Batch: Target journal template and batch

Description: User-friendly template description

Advanced Options

Count Heads Line: Number of header rows to skip in Excel

New Doc. No. per Line: Generate unique document numbers per line

Use Account Description: Use account name as transaction description

Business Account: Default business account for all imported lines

Type/Type Code: Default account type and number for lines without account specification

Processing Options

Use Factor: Apply multiplication factors during import

Use Sequence: Process columns in specific sequence order

Column Mapping Setup

Mapping Configuration

Access through Import Journals → Mapping Setup

General Ledger Column Mappings

Account Type: Maps to G/L Journal Account Type enum

Account No.: Maps to Account No. with formatting rules

Posting Date: Maps to Posting Date with date validation

Document Type: Maps to Document Type enum

Document No.: Maps to Document No. field

Description: Maps to Description with concatenation options

Department: Maps to Shortcut Dimension 1 Code

Project: Maps to Shortcut Dimension 2 Code with validation

Amount: Maps to Amount with numeric validation

Business Account: Maps to Sve Business Account with validation

Advanced Mapping Options

Fixed Type/No.: Override account type and number for specific columns

Description Line: Use fixed description instead of Excel content

New Line: Create new journal line for this column

Import Sequence: Control processing order of columns

Factor: Apply multiplication factor to numeric values

Complex Account Mapping

The system supports sophisticated account mapping based on multiple criteria:

Mapping Hierarchy (Priority Order)

Exact Match: Account + Dimension + Business Account

Account + Dimension: Without business account specification

Account + Business Account: Without dimension specification

Account Only: Basic account-level mapping

Dimension + Business Account: Without specific account

Dimension Only: Department-based mapping

Business Account Only: Service-type based mapping

Use Cases

Department-Specific Accounts: Map expenses to different accounts by department

Service-Type Routing: Route revenues to accounts based on business account type

Project Accounting: Direct project costs to specific account structures

Default Handling: Provide fallback mappings for unmapped combinations

Import Process Workflow

Step 1: Template Setup

Navigate to Import Journals → Setup

Create new import journal header

Configure journal type and target batch

Set processing options and defaults

Step 2: Column Mapping

Open Mapping Setup from import journal

Define Excel column to BC field mappings

Set up complex mapping rules if needed

Configure text line insertions for invoice batches

Step 3: File Upload and Import

Open import journal template

Use Import from Excel action

Select Excel file and worksheet

Review import parameters

Execute import process

Step 4: Validation and Review

System validates imported data

Creates missing customers/vendors if configured

Applies complex mapping rules

Generates journal lines in target batch

Opens target journal for review

Step 5: Posting

Review imported transactions

Make manual adjustments if needed

Post journal lines using standard BC posting

Generate audit trails and reports

Error Handling and Validation

Data Validation Rules

Numeric Fields: Validates amounts, quantities, and dates

Account Numbers: Verifies account existence or creates if configured

Dimensions: Validates dimension codes against master data

Business Accounts: Ensures business account codes exist

Kennitala: Validates Icelandic social security numbers

Common Errors and Solutions

Import File Issues

Problem: "Filename missing" error

Solution: Ensure Excel file is selected and accessible

Problem: Sheet name not found

Solution: Verify Excel worksheet name matches import configuration

Data Validation Errors

Problem: "Field does not contain a legal number"

Solution: Check numeric format in Excel, remove text formatting

Problem: "Business Account does not exist"

Solution: Create business account or update mapping configuration

Problem: "Social security no. is wrong"

Solution: Verify kennitala format (10 digits) and checksum validation

Mapping Issues

Problem: Transactions imported to wrong accounts

Solution: Review and update complex mapping setup

Problem: Missing dimension codes

Solution: Ensure dimension values exist or update import data

Best Practices for Error Prevention

Data Preparation: Clean Excel data before import

Template Testing: Test import with small datasets first

Mapping Validation: Verify account and dimension mappings

Backup Strategy: Export journal before importing new data

Integration with Business Processes

Month-End Processing

Import bank statements and reconciliation data

Process departmental expense allocations

Import fixed asset depreciation calculations

Load budget vs. actual variance data

Payroll Integration

Import salary journal entries with employee dimensions

Process benefit and deduction postings

Handle payroll tax and statutory reporting entries

Link to salary statement management

External System Integration

Import from ERP systems and subsystems

Process electronic bank files

Handle tax authority data imports

Integrate with asset management systems

Advanced Features

Batch Processing

Process multiple Excel files in sequence

Handle large datasets with memory optimization

Support for scheduled/automated imports

Error logging and recovery mechanisms

Template Management

Save and reuse import configurations

Share templates across users and departments

Version control for mapping changes

Template validation and testing tools

Audit and Compliance

Complete audit trail of import activities

User tracking and authorization

Data validation logging

Regulatory compliance reporting

Troubleshooting Common Issues

Performance Issues

Problem: Large files import slowly

Solutions:

Split large Excel files into smaller batches

Use filtering to import only necessary data

Process during off-peak hours

Consider increasing system memory allocation

Data Accuracy Problems

Problem: Incorrect account classifications

Solutions:

Review and update complex mapping rules

Validate source data quality

Test mapping with known data samples

Implement additional validation rules

Integration Challenges

Problem: External system format changes

Solutions:

Monitor source system updates

Maintain flexible mapping configurations

Implement data format validation

Create format conversion utilities

Key Benefits

Efficiency: Dramatically reduces manual data entry time

Accuracy: Eliminates transcription errors through automated validation

Flexibility: Supports multiple journal types and data formats

Integration: Seamless connection with Business Central workflows

Automation: Auto-creation of missing master data records

Scalability: Handles large volume imports efficiently

Audit Trail: Complete tracking of import activities

User-Friendly: Intuitive setup and operation

The Import Journals module transforms how municipalities handle external financial data, providing robust, flexible, and automated import capabilities that integrate seamlessly with Business Central's native functionality.